In the intricate web of American finance, debt is a constant thread. From mortgages and medical bills to credit cards and student loans, personal debt has become an inseparable part of everyday life. Yet what happens when a debt falls into delinquency? Who steps in when payments lapse, phone calls go unanswered, and creditors seek restitution? – Midland Credit Management.

Enter Midland Credit Management (MCM), one of the largest and most recognized names in the debt purchasing and collection industry. But their presence also sparks complicated emotions: relief for creditors, dread for consumers, and sharp debate among policymakers and advocacy groups.

Today, understanding the function, practices, and evolution of Midland Credit Management offers not just insight into one company, but a window into how America grapples with financial accountability, second chances, and the power dynamics between corporations and individuals.

Origins: A Company Born from Financial Necessity

Founded in 1953, Midland Credit Management started as a modest collection agency. Over the decades, as the American economy grew more credit-dependent, the need for specialized companies to recover delinquent accounts also surged.

Rather than operate solely as a traditional collector, Midland evolved into a debt buyer — purchasing large portfolios of defaulted consumer debt at discounted prices from banks, credit card companies, telecom firms, and other lenders.

By acquiring these debts, MCM took on both the risk and reward: if they could convince consumers to repay even a portion of the balances, the profits could be substantial.

Today, MCM is a subsidiary of Encore Capital Group, a publicly traded firm, and has expanded operations across the United States, Canada, and other markets.

The Mechanics: How Debt Buying Works

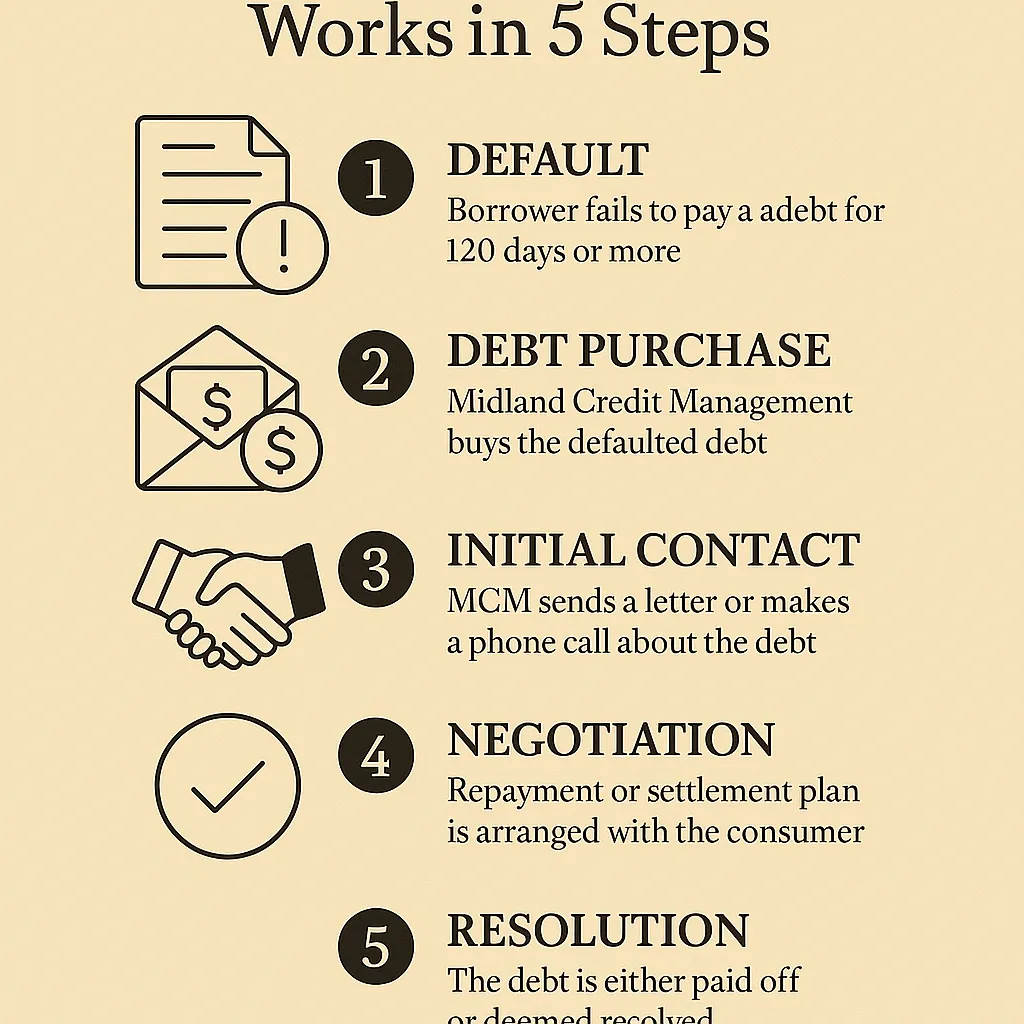

To the average consumer, the notion of their debt being “sold” may feel unsettling or confusing. Here’s a simplified breakdown:

- Default: A borrower fails to pay a debt for a prolonged period (typically 120-180 days).

- Charge-Off: The original creditor writes off the debt as a loss on their books.

- Sale: The creditor sells the debt to a company like Midland Credit Management for pennies on the dollar.

- Collection: MCM now owns the debt and seeks repayment, either through direct negotiation or, occasionally, litigation.

Because they purchase debts for such steep discounts (sometimes 4 to 10 cents on the dollar), debt buyers can profit even if consumers settle for amounts significantly less than the original balances.

Consumer Experience: The First Contact

For many consumers, the first interaction with Midland comes via a letter, a phone call, or sometimes even a lawsuit. The letter typically explains:

- That Midland now owns the debt.

- The balance owed.

- Options for repayment or settlement.

Midland positions itself as a company that “helps consumers find paths to financial recovery,” offering payment plans and discounted settlements. Their communication emphasizes negotiation and resolution rather than immediate confrontation.

Yet for consumers unaware of their rights, or overwhelmed by previous financial failures, this contact can feel intimidating and confusing.

Understanding Consumer Rights: The FDCPA and Beyond

The Fair Debt Collection Practices Act (FDCPA) governs how debt collectors — including Midland — must behave. Among the protections:

- No harassment or abusive language.

- No calls at unreasonable hours.

- Clear disclosure of the debt and the consumer’s right to dispute it.

- Ceasing collection efforts upon written dispute until verification is provided.

Midland Credit Management, like other large agencies, publicly states its adherence to FDCPA guidelines. However, lawsuits and complaints over the years have illustrated the challenges of managing thousands of interactions daily.

Consumers should know:

They have the right to request debt validation — proof that the debt is legitimate and that the collector has legal authority to pursue it.

The Legal Frontier: When Midland Goes to Court

Midland is no stranger to the courtroom. In fact, pursuing lawsuits against debtors is a key part of many debt buyers’ strategies.

Typically, Midland may file a lawsuit seeking a default judgment — meaning if the consumer does not respond to the lawsuit, the court automatically rules in Midland’s favor. With a judgment, Midland can seek wage garnishments, bank levies, or property liens.

Yet courtrooms also present vulnerabilities for debt buyers. Missing documentation, expired statutes of limitations, and chain-of-custody issues can — and do — lead to dismissed cases.

Increasingly, consumer advocacy groups encourage individuals to respond to lawsuits, demand evidence, and assert their legal rights.

The Shift Toward Compliance and Reputation Management

In recent years, facing regulatory scrutiny and a shifting cultural climate around debt collection, Midland has invested heavily in compliance measures and reputation repair.

Some initiatives include:

- Consent Orders: Settlements with regulators requiring changes to collection practices.

- Consumer-Friendly Programs: Initiatives like hardship programs, flexible settlements, and clear communication channels.

- Transparency Reports: Publishing data on complaint resolution and consumer satisfaction.

This new approach reflects broader industry trends: compliance is no longer just a legal obligation; it’s a strategic necessity for companies seeking long-term survival.

The Bigger Picture: Debt Collection in Modern America

Understanding Midland Credit Management also requires grappling with uncomfortable truths about American society:

- Household debt levels are at historic highs, fueled by easy credit, medical expenses, and economic volatility.

- Financial literacy gaps leave many consumers ill-equipped to manage complex credit relationships.

- Economic inequality ensures that debt burdens disproportionately affect marginalized communities.

Debt collection companies like Midland exist because there is a massive, systemic need — but their existence also raises ethical questions about how we, as a society, treat financial failure.

Is debt a moral failing?

A personal mistake?

A systemic inevitability?

There are no simple answers.

Critics and Controversies: A Complicated Reputation

Despite efforts at reform, Midland Credit Management has faced persistent criticism over the years:

- Robo-signing scandals, where mass-produced legal documents were submitted without proper review.

- Aggressive litigation tactics, sometimes involving lawsuits over debts too old to be legally enforceable.

- Communication breakdowns, leading to confusion or distress among consumers.

Advocates argue that these issues illustrate deeper flaws in the debt collection ecosystem — one that too often prioritizes efficiency over human dignity.

Midland’s defenders, however, argue that they offer consumers valuable opportunities: to settle debts for less than owed, to clear credit reports, and to rebuild financial health.

Looking Ahead: The Future of Midland Credit Management

As we move deeper into the 21st century, several forces will shape the future of companies like MCM:

- Technology: Automation and AI will streamline collections but raise new concerns about fairness and transparency.

- Regulation: Governments may tighten rules around debt buying and reporting practices.

- Consumer Empowerment: Greater awareness of rights and legal options will shift power dynamics.

Midland will likely continue adapting—balancing profitability with compliance, and automation with consumer trust.

The role of the debt collector may evolve from adversary to financial partner — a shift that would have seemed unthinkable a generation ago.

Conclusion: Navigating a Necessary Tension

Midland Credit Management occupies a unique space: part villain, part savior, depending on whom you ask.

For some, MCM is a lifeline — offering a second chance to settle old debts and move forward. For others, it symbolizes a faceless machine profiting from human misfortune.

The truth lies somewhere in between.

What’s clear is that debt collection is an inevitable consequence of a credit-driven society. And navigating that reality — ethically, humanely, and transparently — will remain one of the great challenges of modern finance.

For consumers, education remains the best defense.

For collectors like Midland, trust remains the ultimate currency.

In the end, amid all the numbers, settlements, and judgments, what remains is a fundamentally human story — one of promises made, broken, and, sometimes, redeemed.